SAINT LOUIS, Mo. — Standard & Poor’s has reduced St. Louis County’s bond rating from AAA to AA-plus, the rating agency announced in a press release on Thursday. The move reflects new criteria that S&P is using to rate general obligation bonds and makes ratings more “transparent and forward looking,” according to the release. The agencies higher standards mean that St. Louis County no longer meet the requirements for the highest rating, AAA.

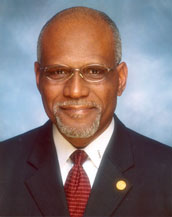

St. Louis County Executive Charlie Dooley, who leaned heavily on the county’s AAA rating during his 2010 campaign in television ad’s referring to him as “Triple A Charlie,” issued a statement to The Missouri Times downplaying the change.

“I concur with the rating agency’s statement that St. Louis County continues to have a strong economy, strong management and strong budgetary performance,” Dooley says in the statement. “The factors that impacted the ratings change have nothing to do with how St. Louis County manages its finances. We are very proud that we maintained our AAA rating through tough economic times and only because of a change in the system did we get a small bump. What matters is we weathered the storm without laying off hundreds of people or filing bankruptcy or spending down our reserves to unacceptable levels. We are in excellent shape and moving forward.”

The change in rating will likely be a factor for Dooley going forward, as he is expecting a primary challenge from St. Louis County Councilman Steve Stenger. Stenger said that the bond rating was a “critical metric,” and that the County should do “everything in its power,” to restore the AAA rating.

“I believe that this is particularly a reflection of a government that has been headlining scandals and frankly failure and we need to turn this around,” Stenger says. “Unfortunately these things take their toll, as a county we should not have to suffer as the result of poor leadership and it looks as though we’re going to.”

Sen. John Lamping, R-St. Louis County, a branch manager at a St. Louis based securities brokerage firm and 27-year veteran bond trader, said the downgrade probably wouldn’t change the cost of capital.

“If you’re going to be downgraded, this is the way you want it to be done,” Lamping says. “If they aren’t giving us a negative outlook then what they are saying is that the standards are higher, so attaining that AAA bond rating is harder than it used to be. Imagine if you get a 99 percent on a test and that’s an A-plus grade. Then your teacher says you have to get 103 percent from now on to get that A-plus. Well a 99 isn’t any worse than it used to be, it just doesn’t get you an A-plus anymore.”

Lamping said that while he didn’t believe the downgrade was reflective of a deteriorating economy, it was a difficult political position for Dooley.

“He ran a lot in his last race on the AAA rating,” Lamping says. “So what happens going forward? Will he be able to explain this situation and will voters respond to it? I’m not sure, I’m sure he’ll tell them that this doesn’t mean the county is worse off, but we’ll see how they react.”

Collin Reischman was the Managing Editor for The Missouri Times, and a graduate of Webster University with a Bachelor of Arts in Journalism.