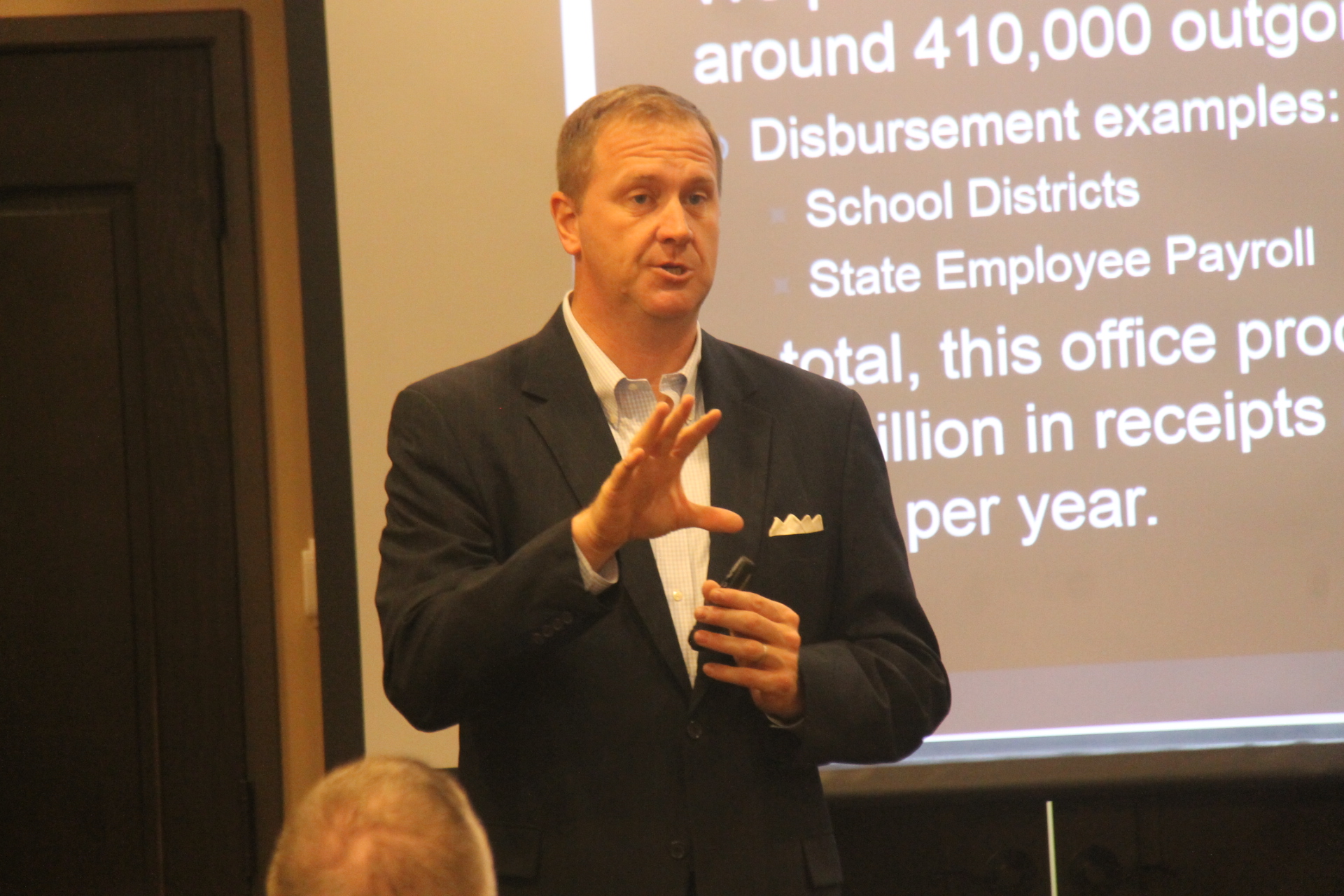

JEFFERSON CITY, Mo. – Missouri State Treasurer Eric Schmitt is continuing his call for change when it comes to the state’s pension liabilities.

Last year, after taking office, Schmitt directed his team to evaluate the state’s pension plans, putting an emphasis on the Missouri State Employee Retirement System (MOSERS). The results, according to Schmitt, were alarming.

Schmitt echoed the sentiments he shared last year while speaking before members of the Central Missouri Chapter of the Institute of Internal Auditors on Tuesday, saying “don’t be like Illinois.”

Schmitt urges Missouri Legislature: ‘Don’t be like Illinois’

The State Treasurer provided some insight to those in attendance regarding the financial and economic state of Missouri, saying that the Show-Me State had managed to do better than the national average in unemployment and labor force participation, though just by a few tenths of a percentage point. He noted that Missouri is not producing as much as its peers and that economic growth in Missouri is still behind that of others.

And as the state’s CFO, he noted that Missouri still had maintained its AAA credit rating, one of 14 states to hold such a title. But, circling back to the issue of pensions, Schmitt said that Missouri was the only AAA-rated state with a pension rate below 70 percent.

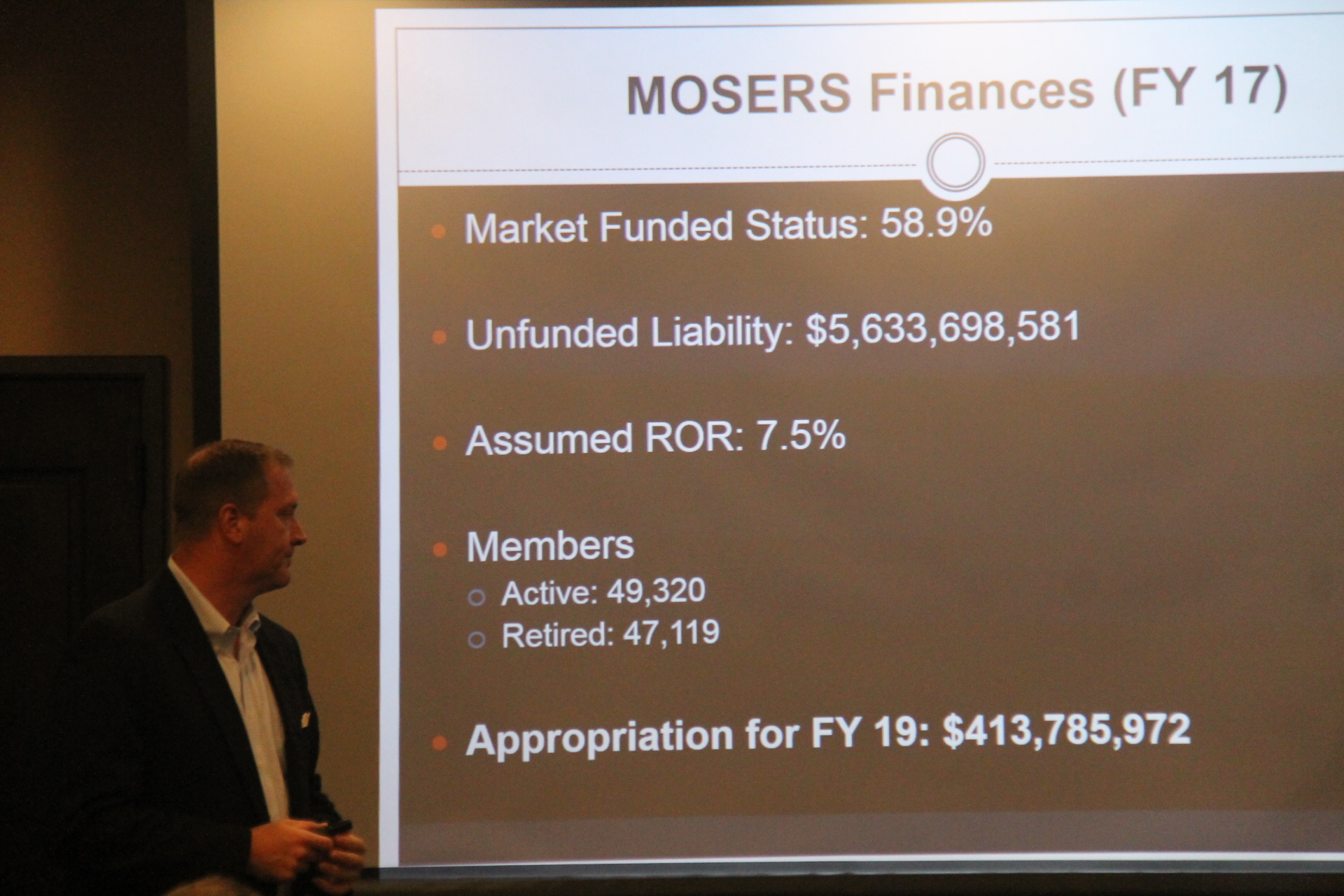

As the state’s chief financial officer, Schmitt penned an editorial in the summer of 2017, calling the state’s pensions a crisis on the doorstep, and saying it was the single greatest threat to Missouri’s AAA credit rating. Last year in June, the unfunded liability of MOSERS had surged past $5 billion, meaning Missouri owed more in pensions than in state bonds.

Schmitt calls on legislature to address pension crisis on Missouri’s doorstep

As the State Treasurer, Schmitt is the only statewide elected official to sit on the MOSERS board. He says that the current state of the pensions over the past few years has left MOSERS just 60 percent funded, which means the for each dollar future retirees are owed, the state has just 60 cents in assets. In the early 2000s, Missouri was nearly one hundred percent funded.

Schmitt attributes those rising debts to a “perfect storm” of bad decisions made in the past, with inflated actuary assumptions that failed to reach their mark, investment fees, and changes in the investment strategies, as Schmitt said, “at the wrong time.”

He pointed out that MOSERS actuary assumptions had carried a rate of roughly 8 percent, and in 16 of the past 17 years, MOSERS had missed its assumptions.

It’s an issue he would like to see changed, and one that he has been advocating since taking office.

Last week, the MOSERS board met in Columbia to discuss the investments and the proposed actuary assumption, though no official vote was taken. Instead, those on the board asked that several proposals be put together and presented before them again with more time to look into.

Schmitt has consistently stated that he hopes to bring the number for the assumed rate of return (7.5 percent) down, in hopes they can begin to address the issue. He says he would prefer to “be pleasantly surprised when you overperform” than disappointed with higher projections that could be missed.

In the end, Schmitt concluded by saying it was time to stop kicking the can down the road, and that decisions made today might not fix things immediately, but it will put the children of the future in a better position.

A vote from the MOSERS board is expected later this summer.

Benjamin Peters was a reporter for The Missouri Times and Missouri Times Magazine and also produced the #MoLeg Podcast. He joined The Missouri Times in 2016 after working as a sports editor and TV news producer in mid-Missouri. Benjamin is a graduate of Missouri State University in Springfield.