JEFFERSON CITY, Mo. — The Show-Me State is doing better than the average state in their financial condition, according to a study that ranked each state on their fiscal health.

Missouri ranks 15th nationwide according to the Mercatus Center at George Mason University’s “Ranking the States by Fiscal Condition, 2018 Edition.” Eileen Norcross and Olivia Gonzalez calculated this year’s rankings from each state’s fiscal year 2016 reports and then applied trend analysis to reports for each year from 2006 until 2016.

The study analyzed state finances in five categories — cash solvency, budget solvency, service-level solvency, long-run solvency, and trust fund solvency — which were then combined to produce an overall ranking of fiscal solvency.

Cash solvency measures whether a state has enough cash to cover its short-term bills, which include accounts payable, vouchers, warrants, and short-term debt. Missouri — which has between 1.97 and 3.72 times the cash needed to cover short-term obligations — ranks 14th.

Budget solvency measures whether a state can cover its fiscal year spending using current revenues. Missouri’s revenues exceed expenses by 3 percent, with an improving net position of $108 per capita. The Show-Me State ranks 26th.

Long-run solvency measures whether a state has a hedge against large long-term liabilities. Long-term liabilities in Missouri are lower than the national average, at 26 percent of total assets, or $1,809 per capita. Missouri ranks 15th.

Service-level solvency measures how high taxes, revenues, and spending are when compared to state personal income. Do states have enough “fiscal slack”? If spending commitments demand more revenues, are states in a good position to increase taxes without harming the economy? Is spending high or low relative to the tax base? A net asset ratio of –0.01 indicates that Missouri does not have any assets remaining after debts have been paid, according to the study. Missouri ranks 8th.

Trust fund solvency measures how much debt a state has. In Missouri, total unfunded pension liabilities that are guaranteed to be paid are $114.25 billion, or 43 percent of state personal income. OPEB are $3.18 billion, or 1 percent of state personal income. Missouri ranks 33rd.

Overall, Missouri ranks 15th among the US states for fiscal health. When historical data from 2006-2016 is calculated into that ranking, Missouri moves up to 14th.

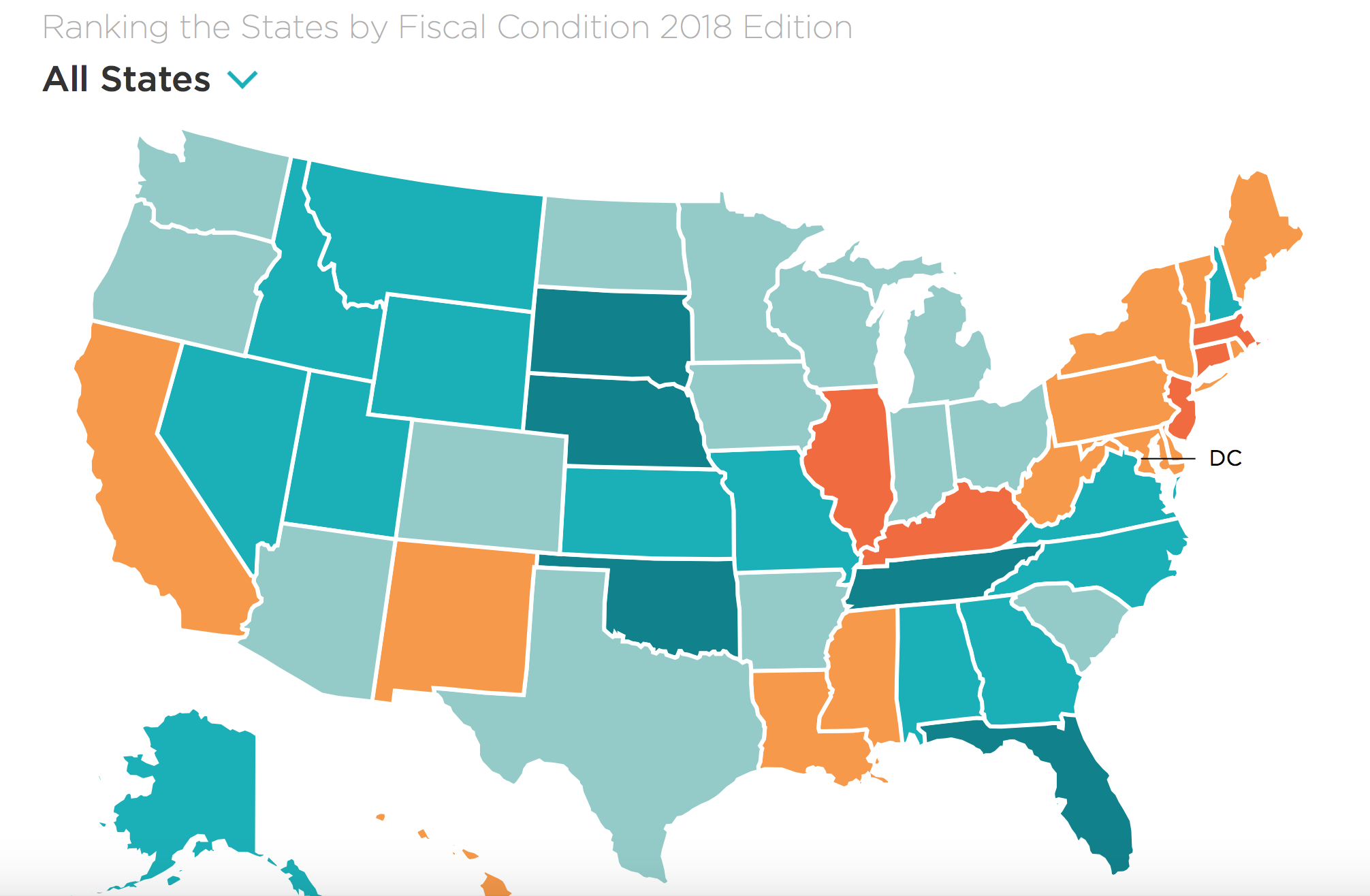

The top five most fiscally solvent states are, respectively, Nebraska, South Dakota, Tennessee, Florida, and Oklahoma. The bottom five states in terms of fiscal solvency are Kentucky, Massachusetts, New Jersey, Connecticut, and Illinois.

Read the full paper below:

Loading...

Loading...

Alisha Shurr was a reporter for The Missouri Times and The Missouri Times Magazine. She joined The Missouri Times in January 2018 after working as a copy editor for her hometown newspaper in Southern Oregon. Alisha is a graduate of Kansas State University.