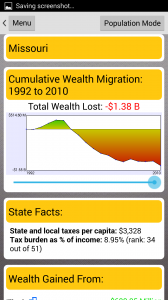

JEFFERSON CITY, Mo. — Travis Brown, founder of Pelopidas, authored a book earlier this year tracking the movement of income around the country, tracking what he says is a common trend of individuals moving (and taking their money with them) to low-income states. Generally, Brown’s overreaching goal is to prove tax data shows a clear link between low-income tax rates and positive economic growth.

The book tracks 15 years of data, using IRS resources and Brown says the book shows, among other things, how millions of dollars has moved from Saint Louis County to Dallas County, Texas over the years.

Brown, a supporter of tax cut legislation who has appeared on cable news advocating for tax reform, also developed an app for the book, commonly becoming the norm among 21st century authors covering data-heavy subjects. The app is proving to be almost more informative than the book, Brown says, and has become very popular. Brown says the electronic access to the data, through his website and the app, is more accessible than a traditional book format.

The app appears as the first result in most app stores when searching the phrase “How Money Walks.” For 2.99, users can download the program. For some, like lawmakers, the data is a valuable resource.

“The app is one of the clearest examples of the positive effect of competitive tax policy on the wealth of states, counties and cities,” Caleb Jones, R-California, says. “It allows people to see for themselves a data driven summary of exactly how money walks.”

“We’re averaging about 10,000 unique hits a month, and a lot of that is people looking to apply some of this data to their own community,” Brown says. “So someone in southern California can download the app and look and see that most of his friends and neighbors are moving either to Vegas or Phoenix, and that’s information that is both interesting to them and possibly a predictor of what they might do one day.

Brown says the app is part of a larger trend that he hopes will better inform tax debates in the future. The ability to look at hard data, he says, prevents debates in the public sphere from delving into philosophical arguments.

“Aggregate data often speaks to someone’s life experience, and it’s important, I think, to be able to get some of this information after you’ve read the book and want to go deeper,” Brown says.