Legislation focused on early childhood education is being praised by the Missouri Champion of Children coalition for addressing the ongoing childcare and early education accessibility and affordability crisis.

Posts published in “Tax Credits”

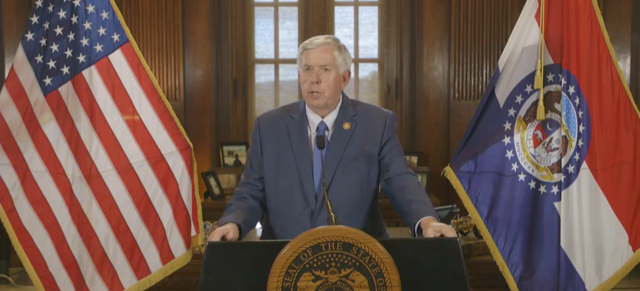

Jefferson City, Mo. — Gov. Mike Parson will bring the Missouri General Assembly into Jefferson City on Sep. 6 to work on multiple tax-related pieces of…

"If we want Missouri to spur entrepreneurship, launch more unicorn startups, and reap the benefits of more high-quality jobs and new economic investment, the state needs to increase its investment in MTC this legislative session."

“We have two projects in New Madrid teed up and ready to go when the legislature approves the rural jobs program,” Richard McGill, the city administrator of New Madrid, said. “We are competing with Tennessee on one and with Ohio on the other, and frankly, this program is the final piece we need to compete and put people to work right now.”

$2.9 billion in state tax credits have been redeemed in the last five fiscal years; $2.8 billion remain authorized but not redeemed as of June 30, 2020.

Rep. Brad Pollitt said the bill included many "priorities" for the Joint Committee on Agriculture as well as Missouri’s agriculture groups for the year.

"This holiday season, while you’re dreaming of a White Christmas, add a little green to a child’s education account."

"While I deployed, they stripped Missouri for parts."

Although artists can use the campus to rehearse, it will not be an entertainment venue.