The Biden Administration’s proposed changes targeting business partnerships present a severe risk that threatens to destabilize vital sectors of our economy.

Posts published in “Taxes”

The Consumer Price Index report for January 2024 shows that prices have risen by 17.9% since President Joe Biden took office.

From 2017 to 2021, Biden was a private citizen and he and his wife, Jill, earned more than $16 million from consulting, book deals and speaking engagements.

Hiking taxes unnecessarily harms consumers...

This week, Americans for Tax Reform founder Grover Norquist sent a letter to the Utilities Committee, Missouri House of Representatives, in support of H.B. 2057...

Hough moved SB 3 and SB 5 be combined into one bill and then moved to perfection. He also moved for the adoption of it.

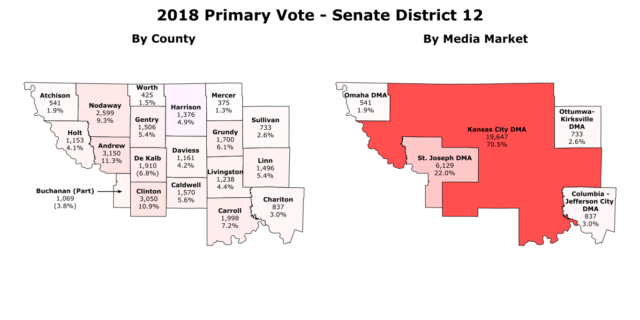

The Republican candidates are Rep. Rusty Black of Chillicothe, Rep. J. Eggleston of Maysville and former Rep. Delus Johnson of Savannah, who served eight years in the House from 2010-2018.

"Those who earn too little to pay income taxes aren't a part of this, they're paying other taxes, they're contributing to general revenue, but they're left entirely out of this," Traci Gleason, a spokesperson for the Missouri Budget Project said.

"With the support of our elected representatives, I believe we can stop these bad ideas before they become law."

"It is time to update our laws that are over 80 years old to match our current situation."