JEFFERSON CITY, Mo. – Although the override of HB 722 made it impossible for municipalities to increase their minimum wage, one senator will look to make good on a promise he made to Kansas City and St. Louis should they attempt to increase the minimum wage

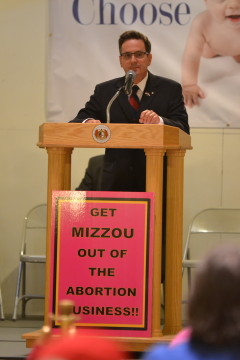

Sen. Kurt Schaefer pre-filed legislation Tuesday that would repeal of earnings taxes in certain cities. Currently St. Louis and Kansas City are the only cities in the state with such an earnings tax.

“These cities are in direct violation of the Commerce Clause of the United States Constitution, and repealing this tax will increase wages for more than a million hardworking taxpayers in Missouri,” he said in a statement. “This is a harsh double-tax on productivity that is severely restricting employment, investment and growth in our state’s two largest cities.”

The bill summary simply says, “Currently, the cities of Kansas City and St. Louis impose an earnings tax and have the authority to continue to impose an earnings tax so long as the earnings tax is reaffirmed by the voters every 5 years. Under this act, no city may impose an earnings tax after December 31, 2017. Further, this act repeals the authority of Kansas City and St. Louis to continue to impose an earnings tax by submitting the tax to the voters of the city.”

In a letter written in June, Schaefer promised that the legislature would take action should the two cities impose higher minimum wages.

“In the event that St. Louis and Kansas City move forward with a $15 minimum wage while clearly lacking the legal authority to do so, the only way employers will have the money to pay those wages is if the General Assembly takes immediate action to eliminate the [one percent] earnings tax currently imposed in both cities,” he wrote.

Both the St. Louis Business Journal and the Kansas City Star reported that the earnings tax in their respective cities brings in around a third of general revenue for those cities. Both earnings taxes must be re-approved by a vote of the people every five years to continue to be implemented, and the last vote for each occurred in 2011. Both passed easily within their cities. Many other cities within the United States have earnings or city income taxes, as well.

Kansas City Mayor Sly James came out in opposition to Schaefer’s measure.

“The suggestion that the earnings tax is dysfunctional ignores the fact that the earnings tax is the single major source of the Kansas City general fund,” he said in a statement. “Three-fourths of the fund supports police and fire services, and those services available to the entire metro area through mutual aid agreements. The earnings tax functions well, as it has for 50 years, and we will be vigorously fighting this wrong-minded legislation in January.”