The Missouri Supreme Court has ruled that counties cannot impose an additional 3% sales tax on recreational marijuana sales within incorporated areas, putting an end to a costly and controversial tax stacking practice.

Top Court Halts Unconstitutional Tax Stacking

The Missouri Supreme Court on Tuesday, in a 6-1 ruling, struck down a controversial tax practice that allowed counties to stack an extra 3% sales tax on recreational marijuana purchases made within incorporated areas, cities, towns, and villages that had already enacted their own cannabis tax.

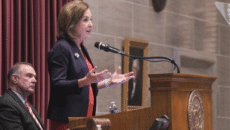

The Majority ruling, authored by Judge Mary Russell, rejected a lower court’s decision that had sided with St. Louis and St. Charles counties, which had argued they were entitled to levy their own tax on top of those applied by local municipalities.

“The plain language of article XIV, section 2 limits the definition of ‘local government’ to allow only one local government to impose a 3 percent tax, a village, town, or city in an incorporated area, and a county in an unincorporated area,” wrote Judge Russell.

Judge Zel Fischer issued the lone dissent in the Supreme Court’s decision, arguing that the state constitution does, in fact, allow counties to collect the 3% marijuana sales tax within incorporated areas.

Fischer took issue with the majority’s interpretation of the term “local government” in the amendment, asserting that it clearly includes both counties and municipalities, even when their jurisdictions overlap.

“The patently absurd results of holding that ‘and’ means ‘or’ and that St. Louis County is not a ‘local government’ within its own territorial jurisdiction confirms, once again, that simply applying the constitution’s plain language meaning is the surest way for this court to implement the law as it was intended,” he wrote.

In Fischer’s view, the ruling unnecessarily restricts counties’ taxing authority and distorts the language voters approved.

$3 Million in Monthly Overcharges Struck Down

Since October 1, 2023, dozens of Missouri counties had been collecting this additional 3% tax, despite voter-approved constitutional language prohibiting such duplication. The 3% local taxes were also at times stacked on top of the state’s 6% tax which was also on top state and local sales tax that consumers would pay on any other retail product. The added cost was burdening consumers to the tune of $3 million per month in overcharges.

The lawsuit to stop the practice was filed just days after it began by Robust Dispensaries, backed by the broader Missouri cannabis industry and the Missouri Cannabis Trade Association (MoCannTrade), on behalf of customers.

Industry Leaders Applaud the Decision

In response to the ruling, Andrew Mullins, Executive Director of MoCannTrade, called the decision a major win for both consumers and the stability of Missouri’s cannabis market.

“Today’s Missouri Supreme Court ruling will directly save Missouri cannabis customers an estimated $3 million every single month. Missouri customers already pay their fair share, with sales tax revenue from cannabis in Missouri now tripling original state estimates,” Mullins said.“This ruling preserves Missouri’s standing as one of the nation’s most impactful and accessible cannabis programs.”

He urged the Missouri Department of Revenue and all local jurisdictions to act swiftly in implementing the court’s decision.

“We are thrilled with the Missouri Supreme Court’s decision to send this case back to St. Louis County with clear instructions to enter a judgment consistent with its opinion. This outcome is a significant win for Missouri consumers, who have been paying millions in unconstitutional sales tax on marijuana purchases since October 2023. By affirming that tax stacking is unlawful under the Missouri Constitution, the Court’s ruling helps ensure that cannabis products sold through the state’s licensed, regulated dispensaries remain an accessible and affordable option. That’s not just a win for consumers; it’s a win for public safety, because when the regulated market remains competitive, Missourians are less likely to turn to illicit sources or unregulated synthetic hemp products. I am proud to have argued this case before the Missouri Supreme Court and could not be more pleased with the outcome we were able to secure for Missouri consumers and dispensaries,” said Eric M. Walter, partner and Cannabis Law practice leader of Armstrong Teasdale, who argued for Robust Missouri.

Counties Respond with Disappointment

Not all local leaders welcomed the ruling. St. Charles County Executive Steve Ehlmann voiced his frustration, not with the court’s logic, but with the constitutional amendment process that tied lawmakers’ hands.

“One thing this shows is how we need to stop putting everything that comes along into the state constitution,” Ehlmann said.“Had this been just a regular law passed by voters, then the legislature could have come back and fixed the question of who can do the tax. But instead, we find ourselves bound by a final decision from the Missouri Supreme Court.”

Despite his criticism, Ehlmann confirmed the county will comply with the court’s ruling.

Ruling Sets the Ground Rules for Cannabis Taxation

With this ruling, Missouri’s cannabis tax landscape is now more clearly defined. Only one local government may impose a 3% tax: municipalities in incorporated areas, or counties in unincorporated areas, but not both. This ensures the cannabis program remains accessible and fair while maintaining voter intent.

As the legal dust settles, Missouri looks to continue to strengthen its and refine its cannabis laws.

Jake Kroesen is a Jackson County native and a graduate of the University of Central Missouri. He holds a B.S. in Political Science.