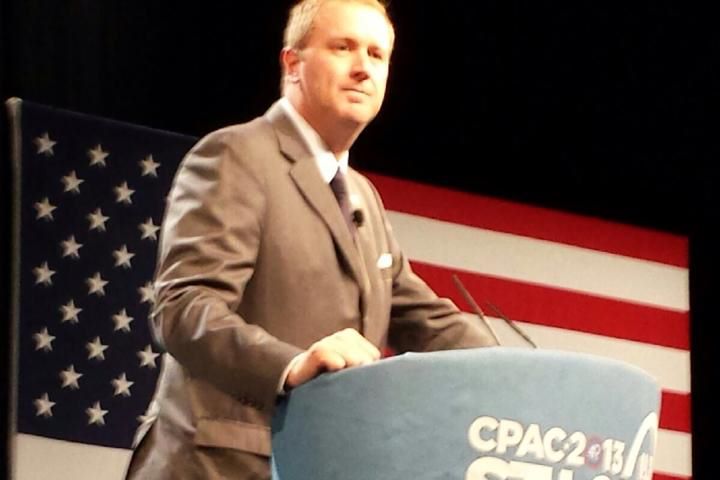

JEFFERSON CITY, Mo. – Sen. Eric Schmitt, R-Glendale, pre-filed legislation Tuesday that aims to accelerate personal income tax cuts as well as business income deductions across the state. Schmitt says both of these measures will help workers and business owners within Missouri to keep more of their earnings.

“We need to continue reforming our tax code so that individuals keep more of their hard-earned money, and small businesses, the backbone of our economy, continue to grow,” he said in a statement. “Our reform is practical, responsible and necessary to get our economy back on the right track.”

SB 574 is identical to the 2015 session’s SB 4, a bill also sponsored by Schmitt. The full language can be read here, but it essentially increases the maximum yields for taxpayers of a plan put forth in 2014. It reduces the top rate on personal income taxes from six percent to five percent instead of five-and-a-half percent. The other part of the bill would allow individual taxpayers to deduct 50 percent of their business income instead of 25 percent.

These changes are both slowly phased in on a rate system. Whenever a general revenue growth trigger is met, the rate moves one more increment toward those final percentages – five percent on personal income and 50 percent business income deduction. The rate of change for both scales have also doubled.

In the end, Schmitt says he wants to save taxpayers money by reducing the amount they must pay and increasing the amount they can write off. He believes that will help Missouri remain competitive.

“While Missouri continues to see sluggish growth, our neighboring states are taking proactive steps to encourage economic expansion and a thriving small business sector,” Schmitt said.

On the other hand, Rep. Jeremy LaFaver, D-Kansas City, did not believe this kinds of bills were prudent, especially since he believes further reductions will further deplete an already stretched state budget.

“It’s not surprising to see these kinds of bills in an election year,” he said. “While appealing in theory, we’ve already seen how these kinds of things have devastated Kansas. I’m sure it will get some attention, but I’m hopeful my colleagues will look to Kansas before we jump on another proposal to slash our state budget.”

Ray McCarty, the president of the Associated Industries of Missouri, disagrees with that assessment. He notes that this plan is specifically different from the Kansas model in two ways. First, instead of these tax cuts coming in in one fell swoop, they are more measured and reserved, taking a longer period of time to get to the end goal. While the design of the bill definitely intends to make sure businesses and individuals have more money to spend, it does not immediately sap the state of all revenue streams to do so.

But second, and perhaps even more importantly, the initial legislation Schmitt’s bill seeks to amend depend on general revenue triggers to take an incremental step towards the end goal. If the state fails to bring in more than $150 million dollars over the highest amount collected in the last three fiscal years, then that step does not happen.

But second, and perhaps even more importantly, the initial legislation Schmitt’s bill seeks to amend depend on general revenue triggers to take an incremental step towards the end goal. If the state fails to bring in more than $150 million dollars over the highest amount collected in the last three fiscal years, then that step does not happen.

“It could take 15 or 20 years at best to hit all the triggers,” McCarty said.

For those reasons, McCarty said AIM was in full support of the legislation.

“Anytime you responsibly allow taxpayers to keep their own money they have a better idea of how to invest that than the government does,” he said. “Our business taxpayers are the medium and small sized businesses which are the backbone of the economy. They employ a lot of people.”