JEFFERSON CITY, Mo. – It seems that the Show-Me State may not be standing on as firm ground as some had thought when it comes to Missouri’s regulatory environment.

While lawmakers debated a number of bills during the legislative session and special sessions, the Regulatory Research Associates (RRA) dropped the state’s credit profile down two notches, an almost unheard rate of decline.

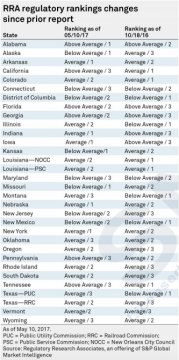

The report, issued by the RRA in May, lowered Missouri from an A2 (Average) rating to a BA1 (Below Average). The move places the state in the bottom nine of all states. Only five states have a worse rating than a Below Average/1.

The reason for this drop? Missouri’s lack of progress in updating laws that date back for decades, or even a century.

“RRA’s ranking of Missouri was lowered to Below Average/1 from Average/2 in light of the state’s inability to adopt meaningful changes to its regulatory structure, despite the considerable effort put forth by the utilities, and the recognition by the Commission and certain members of the legislature that certain changes could be warranted. The state’s traditional approach to ratemaking is less investor-friendly than the more constructive frameworks now being utilized in many other jurisdictions.”

“RRA’s ranking of Missouri was lowered to Below Average/1 from Average/2 in light of the state’s inability to adopt meaningful changes to its regulatory structure, despite the considerable effort put forth by the utilities, and the recognition by the Commission and certain members of the legislature that certain changes could be warranted. The state’s traditional approach to ratemaking is less investor-friendly than the more constructive frameworks now being utilized in many other jurisdictions.”

That statement from the RRA lays the blame on the Missouri Public Service Commission and Missouri’s legislature, most notably because of the lack of changes being taken to update the state’s aging infrastructure or revamp the rate mechanisms that have been in place for literally decades. Other states have taken steps to upgrade their grids and implement newer rate mechanisms more in line with the changing technology, which has led to better ratings on their part from the RRA. In fact, Pennsylvania was moved up to an AA3 (Above Average) from their previous A2 rating, due to their transition to using fully forecasted test years and the implementation of new mechanisms through quarterly rate adjustments.

Just one year ago, Missouri sat firmly in the middle with an A2 rating. The Missouri Energy Group (MEG) and Missouri Industrial Energy Consumers (MIEC) both provided written testimony to the Missouri Public Service Commission in 2016, saying that the RRA’s ranking proved that the Show-Me State was doing fine.

“The supportive nature of Missouri regulation is also found in assessments from Regulatory Research Associates (“RRA”), an independent research firm specializing in utility securities and regulation,” the MEG wrote. “In their assessment of state utility commissions, RRA assigned Missouri regulation an A2 rating. As shown, this places Missouri solidly among other state utility commissions. Clearly, given this A2 rating, the Missouri Commission is fulfilling its duty to balance the interests of utility shareholders and customers.”

“It is also important to recognize where Missouri stands among the states in terms of its regulatory environment. Attachment 1 is a graph that shows how the Missouri regulatory environment compares with those of other states,” the MIEC statement reads. “As shown on the graph, Missouri is solidly in the middle with an A2 rating. This is reflective of the balance that the Missouri regulatory process has achieved. Note that the “average” ranking for Missouri is described as “constructive regulatory environment from an investor viewpoint.” It is certainly important to recognize that from an investor point of view, Missouri’s regulatory process is considered to be constructive. Interestingly, the neighboring state of Illinois, which is sometimes touted as being superior to Missouri because of “formula rates,” is actually ranked BA1, two complete notches below Missouri from an investor’s perspective.”

Since then, Illinois has actually been upgraded.

But why does this matter to Missourians?

Some say that the risk here is that RRA’s downgrade could lead to much higher borrowing costs, meaning more money from customers’ pockets.

The news comes after a special session which secured the pathway to allow a new aluminum smelter and steel mill to get a special rate to operate in Missouri, but further initiatives that had been included in the initial language had been removed. Some lawmakers had pushed for legislation to modify the ratemaking provisions of the state’s laws, but that portion of the final bill had been eliminated, as it was perceived as the one holdup left before the bill could be passed.

Several senators and representatives acknowledged that energy and utility issues needed to be addressed down the line, but the general consensus following the special session at the end of May was that it would have to wait until the next legislative session, which begins in 2018.

Benjamin Peters was a reporter for The Missouri Times and Missouri Times Magazine and also produced the #MoLeg Podcast. He joined The Missouri Times in 2016 after working as a sports editor and TV news producer in mid-Missouri. Benjamin is a graduate of Missouri State University in Springfield.