Saint Louis, Mo. — A task force appointed by Gov. Jay Nixon to make a new NFL stadium in Missouri a reality is seeking $50 million in tax breaks from the state over the next three years.

A presentation was made to the Missouri Development Finance Board whch administers a range of financing programs for Missouri businesses, local governments and state agencies, like issuing tax-exempt industrial revenue bonds.

Technically, the presentation is making three separate requests for $15 million in incentives this year, $17.5 million next year and $17.5 million in 2017. The finance board will reach a decision about the 2015 request within the next two months.

The request for funds come as leaders say they anticipate the Rams will make a decision about a potential move to Los Angeles in late 2015 or early next spring, which supporters of the proposal say creates some real deadlines for any stadium project.

The extension of bonds still plays a significant role in the funding plans for a new stadium despite opposition in the form of at least two separate lawsuits challenging Nixon’s authority to extend such bonds. Under the current proposal, more than $130 million in bonds would come from the state while another $66 million would come from St. Louis City.

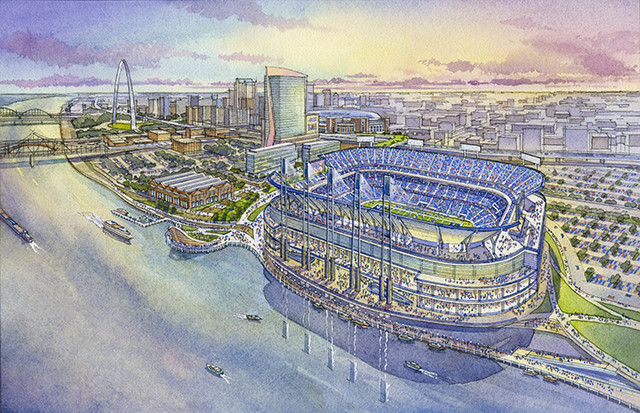

The full cost of the stadium is estimated just shy of $1 billion dollars at $998 million. More than $800 million of that is set aside for construction.

Leaders in St. Louis have been scrambling to find ways to fund and build a new NFL stadium since news broke last January that Rams owner Stan Kroenke was planning to build an 80,000 seat stadium in Inglewood, which many took as a sure sign he intended to move the team back to the L.A. market, where the rams played from 1946 to 1994.

Some state lawmakers have voiced opposition to Nixon’s plan to extend existing bonds on the Edward Jones Dome — the Rams current home — and say the Democrat governor lacks the authority to issue new bonds. At least two lawsuits have been filed both in St. Louis city and Cole County courts.

The finance board has until as late as September to make a decision about the first round of tax breaks.

Collin Reischman was the Managing Editor for The Missouri Times, and a graduate of Webster University with a Bachelor of Arts in Journalism.