By Brad Douglas

Credit unions and other small financial institutions help our communities in Missouri thrive and grow. Small businesses that provide key services to consumers and serve as the backbone of our communities depend on credit unions and small banks to provide the loans they need to succeed. Consumers also count on these small community-based financial institutions when they need a car loan or a mortgage.

Getting these loans to the people who need them most has become harder and harder, due to regulatory restrictions on local financial institutions. It’s time to right-size regulations and fix the unintended consequences created by Washington bureaucracy.

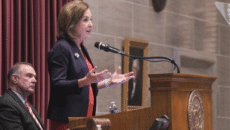

The Heartland Credit Union Association and the credit unions in Missouri applaud original cosponsor Senator Claire McCaskill and cosponsor Senator Roy Blunt for leading the way with S. 2155, the bipartisan Economic Growth, Regulatory Relief and Consumer Protection Act. This common-sense bill is supported by U.S. Senators from both sides of the aisle. It delivers on its promises and keeps important consumer protections in place while allowing community-based financial institutions – like credit unions – to do their job and improve the financial well-being of the working families they serve.

Key provisions in this bill ease mortgage lending and free up capital for small businesses. These two essential steps will help grow an economy that has suffered from both a financial crisis and the impact of regulations that treat all financial institutions the same without focusing on the bad actors who led us into the financial crisis.

The bill also provides parity for consumers who seek to purchase rental properties with up to four apartments in them, by treating these types of loans the same way at both credit unions and banks. That will free up loan dollars that can be used to help more small businesses and reinvigorate communities.

The economic growth bill is a major step forward in addressing the needs of credit unions and other small financial institutions. By tailoring regulations rather than a one-size-fits-all solution, S. 2155 gives Missouri credit unions more ways to efficiently serve working families across the Show-Me State:

- Empowers credit unions to spend more time and resources addressing member service needs and providing consumer-friendly products and services by adjusting reporting thresholds.

- Gives consumers better and more efficient ways to purchase a home – like making it easier for creditors to extend a second offer of a mortgage loan as soon as it becomes available.

- Helps protect senior citizens vulnerable to elder financial abuse.

- Pushes the U.S. Treasury to study ways to better combat cybercrime.

One thing this bill is not – it is NOT a free pass for Wall Street. It strengthens consumer protections and keeps Dodd-Frank Act reforms in place that address problems caused by big Wall Street banks and others.

At a time when Washington doesn’t seem to agree on much, more than 20 Senators from both parties have signed onto this bill. That includes BOTH senators from our state. Regulatory relief isn’t a Democrat vs. Republican issue. It’s about helping people. Overregulation hurts hard-working Missourians and hinders our small businesses, which isn’t good for our communities or the economy.

The credit unions of Missouri thank Senators McCaskill and Blunt for joining together to support S. 2155, which will go a long way to improve the financial well-being of the 1.5 million Missourians we serve, each and every day.

Brad Douglas is the President/CEO of Heartland Credit Union Association.