As elected officials vacate Jefferson City and return to their families and jobs, The Missouri Times is taking a look at legislative priorities that may headline next year’s session. The “Next Steps” series will showcase certain legislative issues and take a look ahead at what could come next.

While taxes are often discussed in the upper chamber, several attempts at altering the state’s property assessment policies have failed to make it across the finish line over the past few years. With the next legislative session around the corner, some lawmakers say they are ready to restart the conversation.

Property assessments are undertaken every odd-numbered year with the results administered the following year, with rates varying from county to county.

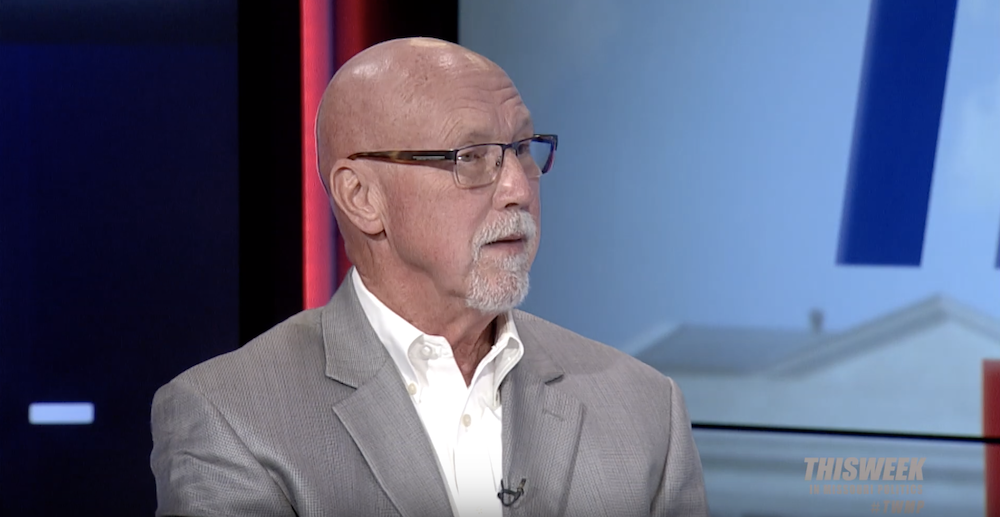

Sen. Mike Cierpiot, who represents part of Jackson County, said he has heard from numerous constituents who have struggled with sudden tax increases, an issue he has tried to remedy for the past two sessions.

This year’s language would have required half of the growth of assessed property values increasing beyond 15 percent to be applied to the current year with the remainder applied to the following year. While current policy applies the total increase the next year, Cierpiot said the abrupt increase is harmful to many property owners.

“Our property taxes are getting out of control and it’s really impacting people with limited means,” Cierpiot told The Missouri Times. “A lot of middle-income people have been very badly squeezed by these rising property tax assessments, and I think we need to do something that makes it predictable and puts a lid on that to a certain extent.”

“We’ve got to find some way to ensure rates are going up at a predictable level even with inflation and not just have it hit people all at once,” the Republican senator continued. “Some people’s property taxes went up 40-60 percent, and that’s just crazy. If the county needs to reassess more often, they should do that rather than hitting people with these massive tax bills that just cripple them financially.”

A report from Auditor Nicole Galloway echoed his concerns earlier this year, finding several assessment contracts had been allowed to expire and appeals from property owners alleviated total evaluations around the county by $246 million.

Cierpiot said a bill to automatically review increases exceeding 15 percent was another route under consideration.

Cierpiot isn’t the only lawmaker setting his sights on property assessment reforms next session: GOP Sen. Tony Luetkemeyer led a bill the past two years that would have capped the growth in assessments of residential real property to 5 percent or the percent increase in inflation, whichever is higher.

“Over the last two assessment cycles, property owners have seen dramatic, surprise increases to their property tax assessments,” Luetkemeyer said. “In some cases, homeowners are being forced from their homes. This is unacceptable. I will again file legislation this year to reign in those abuses.”

A situation that is unique to Cierpiot’s district, however, is Jackson County’s assessor status as an appointed official. While voters approved 2010’s Amendment 1, which made all other charter county assessors elected positions, Jackson County was excluded from the mix.

Cierpiot sponsored an attempt to put the change on the ballot during the past two sessions; this year’s effort made it out of committee but did not reach the floor for discussion.

“There are a gazillion properties in Jackson County, so it’s a very difficult job, but some people have just been obliterated by this,” Cierpiot said. “We need to figure out a way to phase it in or put a cap on it, but it might also make it more real to the assessor when they have to answer to the voters instead of just the Jackson County executive. That’s the way most counties do it, and I believe Jackson County should do the same.”

Cierpiot said he would work with lawmakers and stakeholders from other large counties to find a path forward and provide relief to his constituents — no matter what form that may ultimately take.

“A lot of people in my district are retirees on fixed incomes. They’re people that have a certain amount of income, and when taxes double as they have, it’s very painful for them,” Cierpiot said. “We need to find a way to make sure it’s predictable even with inflation and not just having all of this fall into their laps.”

Cameron Gerber studied journalism at Lincoln University. Prior to Lincoln, he earned an associate’s degree from State Fair Community College. Cameron is a native of Eldon, Missouri.

Contact Cameron at cameron@themissouritimes.com.