JEFFERSON CITY, Mo. – Auditor Nicole Galloway released an audit report Wednesday morning, evaluating the cost to the state of tax exemptions over the past couple years and estimating their longterm effects.

According to the report, many of the fiscal notes predicting the cost of a bill are inaccurate and fail to monitor their economic impact, should they pass. Her most notable finding was a bill that cost the state over five times its initial fiscal note.

“To encourage economic growth, policymakers have implemented incentives and exemptions in the state’s tax code. The goal is to encourage business formation and expansion,” Galloway said. “However, my audit found that the state has no idea whether these incentive and exemptions are working for their intended purpose.”

According to Missouri law, fiscal notes are given to bills to project their impact over the following two years or longer if necessary. The notes are completed with the most recent complete data and may determine an unspecific financial impact. Despite their lack of exactness, the fiscal notes are often heavily trusted when considering a bill. She recommends a system used in Tennessee that would continue to evaluate the cost of each bill up to five years after it passed. Missouri has no such system to verify that bills have the economic impact as projected.

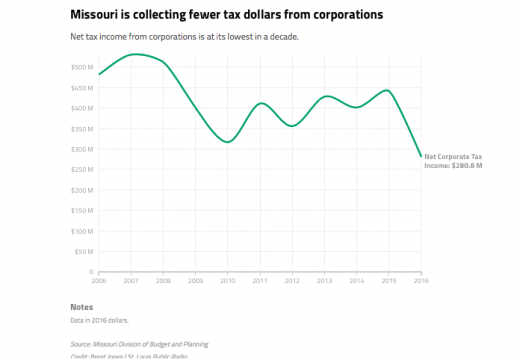

Her most notable example is SB 19. The corporate apportionment bill allows cooperations to choose each year what kind of corporate apportionment metric they wanted to pay their taxes. The bill was passed in 2015 and was designed to make cooperations more willing to operate out of Missouri. In her audit, she found that policymakers “significantly underestimated the loss in state revenue due to the bill.”

Since the bill passed, the initial analysis of the bill predicted the state would expect not to collect $15.2 million dollars per year and by this time, the state was expected to not collect $30.4 million in corporate taxes. According to Galloway’s findings, the bill cost the state about $177 million in corporate taxes because of the law, almost five and a half times more.

“The fiscal impact of that bill was [projected to be] about $15 million dollars [per year] and after implementation is now about $177 million. We asked the Department of Revenue about what accounted for that change. Certainly, they recognize that SB 19 was part of the reason for that,” Galloway said. “The bulk of this decline, the $177 million, would be from the physical impact of SB 19.”

Her audit also investigated the timely withholding tax discount, which was passed in 1973 to encourage business to file their employee withholdings in a timely manner. At the time, income tax withholding calculations were done by hand. Because of this tax policy, $29 -$28 million in withheld tax income revenues were collected from employees.

She recommends the Missouri legislature evaluate the necessity of the timely withholding discount.

“What we want to do is make sure that policymakers have the best information possible,” she says. “I’m not saying exemptions are bad; I’m not saying incentives are bad. They can be useful tools, but as a taxpayer, we want to know that each one works as it should and as taxpayers we are getting a return on our investment.”

Because of unexpected tax collections, the Governor has been constitutionally forced to withhold funds, which has forced Missouri to compromise on funding certain departments.

“Certainly we have a significant budget crisis here in Missouri,” Galloway said. “Over the past 20 years, policy decisions have been made that led us to where we’re at today. We need to take a realistic view on what the budget is and the legislature should want to have as much information as possible to be able to craft that budget and policy decisions.

Michael Layer is a reporter for the Missouri Times and the Missouri Times Magazine. He joined the Missouri Times in August 2017 after graduating from Goucher College the previous May. To contact Michael, email michael@themissouritimes.com or follow him on Twitter @_MichaelLayer