Key Points

- Missouri could hold up to 150,000 metric tonnes of cobalt, potentially one of the largest reserves in North America.

- The Bureau of Land Management recently approved 36 mine lease renewals for Doe Run, securing continued mineral production in the Mark Twain National Forest.

- A 2024 Missouri bill, the Defense and Energy Independence Act, proposed $40 million in annual tax credits and $10 million in state grants to expand domestic mineral production.

- Missouri also sits on over 103 million pounds of nickel, positioning the state to play a major role in U.S. efforts to reduce reliance on Chinese-controlled mineral supply chains.

When the COVID-19 pandemic rattled global supply chains, it exposed a truth the U.S. could no longer ignore: America depends heavily on foreign nations, often geopolitical rivals, for resources ranging from medical supplies, critical minerals, and more. Today, and long into the future, critical minerals are the backbone of many important industries in the world such as Tech and National Defense. These minerals power everything from electric vehicles to advanced defense systems.

Now, as Washington races to rebuild domestic capacity, Missouri is emerging as a surprising player in this new industrial contest. With vast untapped mineral reserves and a century-old mining heritage, the state could soon play a pivotal role in securing the raw materials that underpin both economic and national security.

A National Imperative

Critical minerals, cobalt, nickel, copper, lithium, and rare earth elements, form the foundation of modern technology and clean energy. They’re also central to defense production, powering jet engines, guidance systems, and advanced batteries.

But today, the U.S. imports more than half of its critical minerals from foreign sources, according to the U.S. Geological Survey (USGS). Even more striking, China controls between 40% and 90% of the global refining and processing capacity for most of these materials

That dominance gives Beijing enormous leverage. In recent years, China has restricted exports of key materials like germanium and gallium, essential for semiconductors and defense systems, as a reminder of how mineral dependency can translate into strategic vulnerability.

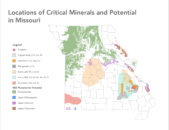

Missouri’s Hidden Reserves

Few Missourians realize just how mineral-rich their state might be. According to a 2024 geological study by the Missouri Geological Survey, Missouri could hold up to 150,000 metric tonnes of cobalt, one of the world’s most sought-after metals.

For comparison, the Democratic Republic of the Congo (DRC), currently the top global producer, mined roughly 170,000 metric tonnes of raw cobalt in 2023 and holds an estimated 6 million metric tonnes of reserves.

Cobalt is essential for manufacturing EV batteries, jet turbines, and advanced communication systems, but the U.S. currently produces almost none. Nearly 70% of China’s refined cobalt comes from the DRC, where Chinese companies dominate both mining and processing infrastructure.

Other destinations for DRC cobalt exports include Tanzania, Zambia, South Africa, Singapore, the UAE, Switzerland, and Belgium, but China remains by far the largest buyer.

If Missouri’s projected cobalt deposits prove economically recoverable, the state could be sitting on one of the largest domestic cobalt reserves in North America, providing a potential alternative to Chinese-controlled supply chains.

Missouri also holds an estimated 103 million pounds of nickel, another critical component for batteries and high-performance alloys.

From Lead to Lithium: A Mining Legacy Reimagined

Mining is nothing new for Missouri. The Southeast Missouri Lead District, centered around the Viburnum Trend, has been home to commercial operations since the early 18th century. Companies like Doe Run have long produced lead, zinc, and copper, forming the backbone of the regional economy.

Now, as global priorities shift toward clean energy and advanced manufacturing, Missouri’s historic mining regions are being re-examined through a 21st-century lens.

State officials and academic researchers, especially at Missouri University of Science and Technology in Rolla (Missouri S&T), are exploring how those same geologic formations might yield new materials critical to America’s next-generation industries.

In 2024, Missouri S&T was designated a U.S. Tech Hub for Critical Minerals Innovation, one of only a handful nationwide. The initiative aims to develop new extraction methods, recycling techniques, and workforce training programs to support domestic mineral independence.

“This is about more than mining, it’s about building a modern industrial ecosystem that can supply our defense, energy, and technology sectors,” said Missouri S&T researchers in the announcement.

Tariffs Could Provide Investment

Missouri’s critical minerals sector could see rapid growth as the U.S.-China trade tensions highlight the risks of foreign dependence. China controls 40–90% of global refining and processing for key minerals, and the U.S. has launched a national security review that could trigger new tariffs if vulnerabilities are confirmed.

Michael Hollomon, commercial director for U.S. Strategic Metals, said Missouri could become a “boom state” for mining and processing, potentially creating thousands of jobs. The company has invested over $265 million in southeast Missouri and expects to produce alloy-grade cobalt for defense and aerospace by next year.

Doe Run Company, a longtime regional miner, urges caution, noting that bringing a new mine online can take five to ten years and requires policy stability.

At Missouri S&T, the Tech Hub for Critical Minerals Innovation is developing safer, more efficient extraction methods. Dr. Kwame Awuah-Offei said consistent policy is essential: “Our economy and national defense depend on these minerals, but without stability, investment is risky.”

The Policy Frontier: Building a Framework for Critical Minerals

While private exploration and academic research are moving quickly, state policy is still catching up. Missouri has no comprehensive framework for supporting critical mineral production, leaving potential projects vulnerable to inconsistent permitting, uncertain incentives, and limited coordination among agencies.

One earlier attempt to tackle that gap came in 2024, when the legislature considered the “Missouri Defense and Energy Independence Act” (HB 1834), sponsored by State Senator Justin Brown and former Rep. Aaron McMullen. The bill, though not enacted, offers a detailed roadmap for how Missouri might structure a statewide critical minerals strategy.

The measure proposed a tax credit system for companies converting operations to produce strategic materials such as cobalt, nickel, and rare earths for U.S. defense and energy projects. It also called for the creation of a “Grants for Independence from Foreign Influence Fund” seeded with at least $10 million in state and federal contributions, to support companies investing in new refining or recycling technologies.

Under the bill, qualified companies could receive up to 15% in tax credits on conversion costs, capped at $40 million statewide per year, and apply for grants of up to $500,000 to offset startup expenses. The proposal also required the Department of Economic Development to verify costs and outcomes, ensuring taxpayer accountability.

Though the measure expired when McMullen left office, the concept has since reemerged in policy discussions among lawmakers and economic development officials, who see potential to adapt its framework for future legislation.

Experts note that reviving and refining such an approach could give Missouri a competitive edge, pairing financial incentives with environmental oversight and workforce training.

Potential state-level solutions include:

- Revisiting a tax credit or grant structure to attract new exploration and refining projects.

- Establishing a Missouri Critical Minerals Task Force to coordinate agencies, industry, and research institutions.

- Partnering with the Department of Defense and U.S. Department of Energy to align projects with national priorities.

Taken together, these measures could help Missouri capitalize on its geological advantages while protecting public lands and communities.

Balancing Growth and Responsibility

Environmental concerns remain a central part of the debate. Past mining operations left behind contamination that required decades of cleanup, a legacy that still shapes public opinion in the state’s Lead Belt.

Advocates for sustainable mining argue that any new mineral projects must prioritize transparency, local engagement, and modern reclamation practices.

National policy experts agree. The Center for Strategic and International Studies (CSIS) emphasizes that responsibly mined domestic minerals can actually reduce global environmental harm by replacing imports from countries with weaker labor and ecological standards.

The Democratic Republic of the Congo for instance, a nation which provides roughly 70-80% of the worlds Cobalt supply, employs child laborers to mine the critical mineral.

From State Strength to National Security

Federal agencies are already investing in this space. The Department of Defense and Department of Energy have launched programs under the Defense Production Act to fund domestic critical mineral projects, while the USGS continues to identify new regions with strategic potential.

Missouri’s combination of infrastructure, research capacity, and geological potential gives it a strong position to benefit from this national effort. The Carnegie Endowment for International Peace notes that partnerships between states, universities, and private industry will be essential to building a resilient U.S. supply chain.

A Strategic Opportunity

With global supply chains strained and China dominating the refining of key minerals, Missouri’s long-dormant mining sector is gaining fresh attention. Federal and state initiatives, from Missouri S&T’s new Critical Minerals Tech Hub to proposed tax credits for domestic production, are positioning the state to play a central role in U.S. mineral security. But experts warn that success will depend on consistent policy, environmental responsibility, and realistic assessments of what Missouri’s geology can truly deliver.

Jake Kroesen is a Jackson County native and a graduate of the University of Central Missouri. He holds a B.S. in Political Science.