The Missouri Times is previewing pre-filed legislation during the month of December, bringing you an insider’s look at bills that could potentially drive session next year. Follow along with our Legislative Preview series here.

Missouri’s motor fuel tax rate hasn’t seen an increase in more than 20 years, though not for a lack of trying. And with the 2021 legislative session less than a month away, the General Assembly is set to once again consider a potential rate hike.

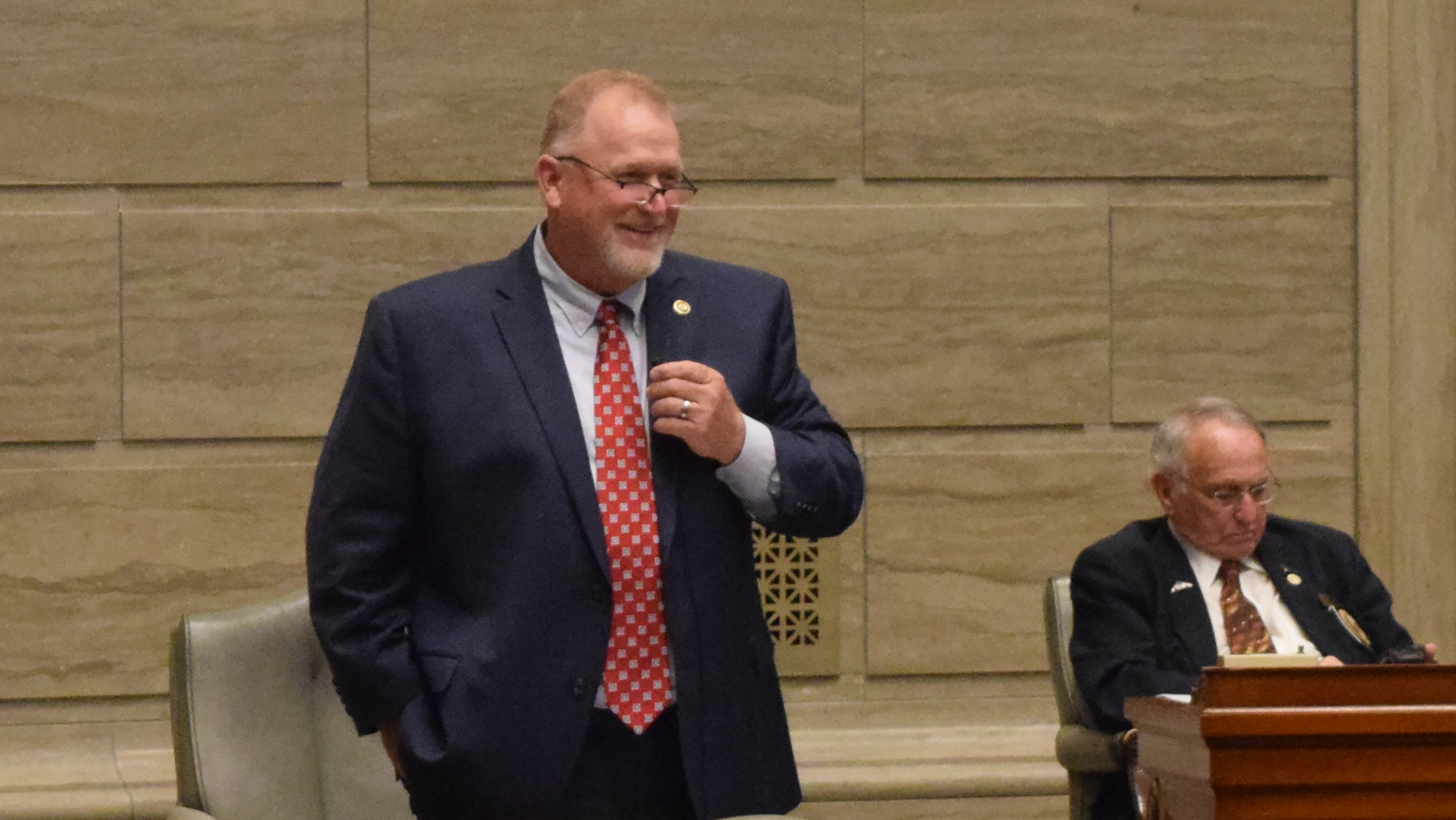

SB 262, pre-filed by Senate President Pro Tem Dave Schatz, would increase Missouri’s fuel tax by 2 cents annually for the next five years. While similar provisions faltered in previous years, Schatz said this session might be better suited to get the bill across the finish line in the legislature.

“It’s gonna be a challenge in any session,” he said. “I’m aware of the dynamic, with a new group of elected officials coming in and voicing some concern, but the best time to do this is outside of an election year. There’s less worry about losing an election because of voting for a tax increase right now than there was last year. I realize it’ll be a challenge, but it’s a priority of mine to find a funding solution, and I’ll do all I can to get that resolved.”

Currently, Missouri implements a gas tax of 17 cents, but Schatz’s bill would increase it to 27 cents by 2026. The tax would go toward maintaining the state’s roads and bridges, a major focus of both Gov. Mike Parson’s administration and Schatz’s time in the statehouse.

The Missouri Department of Transportation (MoDOT) reported this summer a majority of the state’s bridges were classified as being in “poor” condition. The department and Parson’s administration earmarked more than $50 million for replacements and repairs through the state’s “Focus on Bridges” program.

“We’ve been trying to maintain our roads and bridges, but we haven’t seen an increase in motor fuel tax since 1996,” he said. “It doesn’t take a rocket scientist to know inflation is hurting our buying power; we’re trying to pay for 2020 roads on 1996 revenues, and that’s just not working. I’m trying to make sure we have something we can work with to find a resolution to the problem. We have to have a long-term solution to try to move forward and prioritize fixing these issues.”

Schatz also proposed a constitutional amendment with the same language, putting it in the hands of Missouri voters in 2022 if it passes through both chambers. Similar hikes were proposed on the ballot in 2014 and 2018, but neither passed.

Missouri’s fuel tax is among the lowest in the nation — only Alaska has lower tax rates in the U.S. The proposed hike would bring it more in line with the national average while hovering below neighboring states like Illinois, where fuel is taxed at a rate of more than 38 cents a gallon.

While he said he believed a fuel tax was likely the best way to do that, Schatz said he was open to other avenues.

“There are other ideas out there we might entertain: There’s a model which allows for a voluntary tax rebate, a creative way they’ve been able to get people to get on board with funding transportation and give them the option to see a return,” he said. “My goal, in general, is to find a funding mechanism outside of general revenue for us to address our roads and bridges.”

Dec. 1 was the first day of pre-filing for the Missouri legislature. The 2021 session begins Jan. 6.